- 05 Apr 2023

- 4 Minutes to read

What is the bid/ask spread?

- Updated on 05 Apr 2023

- 4 Minutes to read

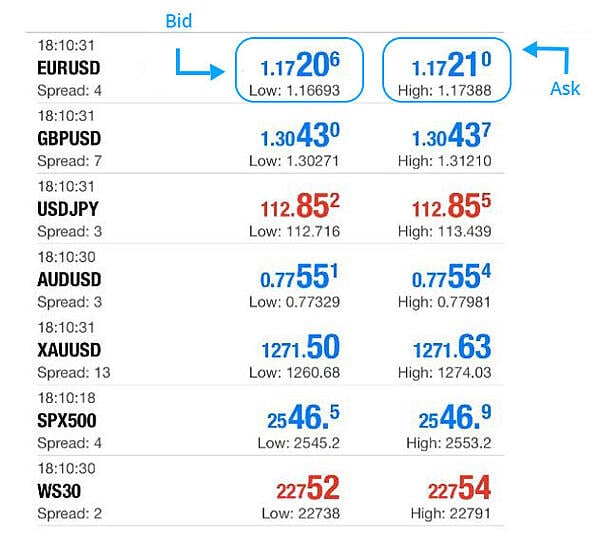

All financial assets are listed with two different prices, the ask and the bid price. The ask price is what someone is willing to sell for. If you are a buyer, you pay the ask price. However, the bid price is what someone is willing to pay if you are selling.

Going long vs. shortselling

Going Long

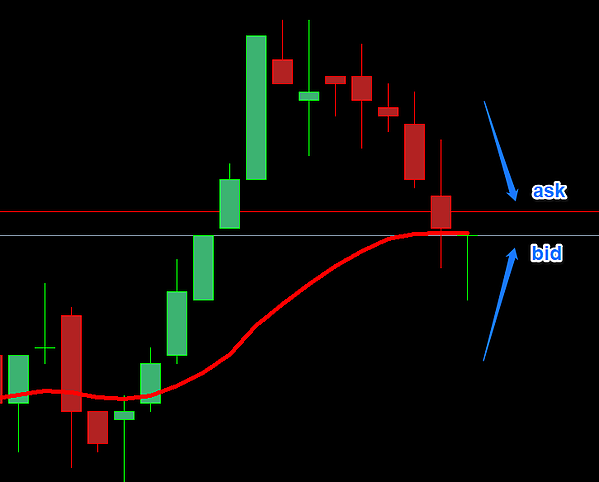

When you go long in a security (buy), the price at which your trade will be executed will be the ask (the highest of the two prices available), but the price you'll be able to close the trade is the bid price. Hence, a trade always starts in the red due to the bid/ask spread. Once the bid price is placed at the same level as the ask price the moment it was purchased, your trade will be at break-even (without taking into account the commissions).

Shortselling

When you go short in a security (sell), the price at which your trade will be executed will be the bid (the lowest of the two prices available), but the price you'll be able to close the trade will be the ask. Hence a trade always starts with a loss due to the bid/ask spread. Once the ask price is placed at the same level as the bid price the moment it was purchased, your trade will be at break-even (without taking into account the commissions).

In summary, trading either long or short involves paying the bid-ask spread. When purchasing (going long or closing a short position) the trade will always be executed at the higher price (ask). When selling (closing a long or going short), execution will always be at the lower of the two prices (bid).

What's the bid/ask spread?

The bid-ask spread is the difference between the price someone is willing to sell for (ask) and the price someone is willing to pay (bid).

The spread is a key indicator of the liquidity of an asset. In general, the smaller the spread, the better the liquidity.

Note that spreads are not constant and vary according to underlying market conditions (volatility and liquidity).

It is not uncommon to see the spread widening considerably before or during the release of high-impact news or important announcements, such as monetary policy decisions of a Central Bank, relevant macroeconomic data, etc.

Bid/Ask in MetaTrader

By default, the price shown by MetaTrader is the bid price of the corresponding asset.

Therefore, it is not unusual that you can find yourself in a situation in which your order has been executed at a price that apparently the market has not reached (according to the historical bid price of the chart).

For example, imagine that you are short on the EURUSD and you have placed a Stop Loss at 1.17220.

Right after a piece of high impact news, the spread widens and the price rises towards your stop level where the spread marks a maximum 1.17184 / 1.17223 (3.9 pips).

Your Stop Loss will be executed when the ask price touches 1.17220,

However, in this case, the bid price never reaches 1.17220 and you may be surprised that an SL order has been triggered since you cannot see the ask price reflected in the chart. This happens because Stop Loss orders are triggered by the ask price. See "Show ask price on MT4/MT5 charts" article.

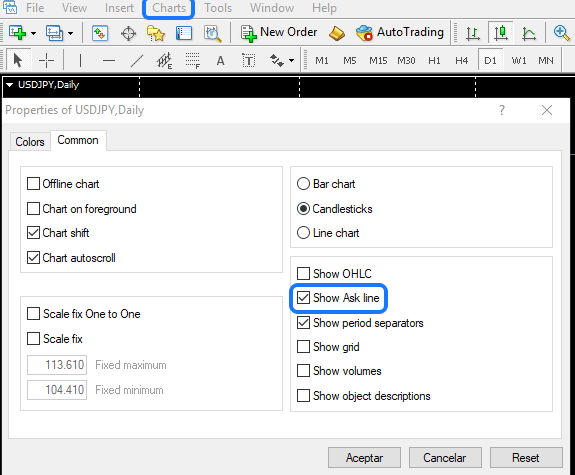

Set up MetaTrader to display the ask price

- In the "Charts / Properties /Common" menu, check the option "Show Ask line":

- In the same menu, tab "Colors", you can choose the colour of the ASK line:

- As a result, you will see a line in the chart showing the "ASK" price:

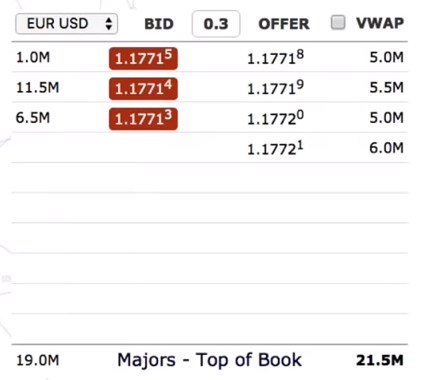

Top of Book

The liquidity of the market is not infinite. The order book of liquidity providers has a book depth based on both the price and volume.

The prices that you can see in MetaTrader are what is commonly known as "Top of Book", that is, the best price available for a given volume.

When you send a market order, if the volume to be executed is higher than that available at the "Top of Book", the remaining volume will be purchased/sold at a price worse than that displayed at "Top of Book".

For example, imagine that you want to place a buy market order in EURUSD for an amount of 13 million (130 lots).

According to the chart, you will buy 5.0 million at 1.17718, 5.5 million at 1.17719 and 2.5 million at 1.17720, thus causing a maximum "slippage", when compared to the best available price, of 0.2 pips. Actual slippage would be a weighted average:

- 5 million with 0 slippage above 13 million (38.46% of total).

- 5.5 million with 0.1 slippage above 13 million (42.30% of total).

- 2.5 million with 0.2 slippage above 14 million (19.23% of total).

(42.30%x0.1)+(19.23%x0.2)=0.08 average slippage on the order.

Fixed and Variable Spread

Darwinex Zero offers its traders the price / liquidity it obtains from its liquidity providers. Therefore, spreads offered at Darwinex Zero are always variable, reflecting the underlying conditions in the market.

Despite the great liquidity of CFDs, at specific moments during the release of high impact news, liquidity is significantly reduced, resulting in a considerable spread widening.