- 07 Oct 2025

- 2 Minutes to read

Calibration stage

- Updated on 07 Oct 2025

- 2 Minutes to read

Once you have created your Darwinex Zero account, there is an initial calibration stage prior to the creation of the DARWIN, which is necessary for our system and risk engine to gather enough information about your signal account to set up the DARWIN replica correctly.

Requirements to create the DARWIN

During the calibration stage you must complete 25 risk-equivalent trading decisions over a minimum of 15 trading days.

There is no requirement in terms of return, our system just needs enough information (measured by the number of trades and trading days) to be able to create the DARWIN.

No minimum return is required to complete the calibration stage but there is a time limit of 90 days from subscription.

This time limit is set for inactivity reasons. However, if you are actively trading, you can take longer than 90 days.

The track-record accumulated during this period will be aggregated to the DARWIN once created.

What is a risk-equivalent trading decision?

In order to calculate the exposure of a trading decision, we follow the steps below, our system calculates the market exposure of each position using the following formula:

Exposure = D-Leverage* x √Time (duration of the position)

Then, to obtain 25 risk-equivalent trading decisions, we perform the following scheme:

- The system takes as a reference the position with the greatest exposure and assigning 1 trading decision to this one.

- To calculate how many representative decisions the remaining positions are equivalent to, the calculation is:

- All position's representative decision are added up to make 25 trading decisions.

The D-Leverage is Darwinex's own tool which standardizes the risk of all positions using the EURUSD as a reference.

To calculate the D-Leverage, we take into account both the nominal leverage and the underlying volatility of all the trades opened simultaneously, and we compare it with an unleveraged trade on the EURUSD.

Example

Imagine a signal account with these positions:

1.- D-Leverage = 20 Duration = 30 minutes / Exposure: 109.5

2.- D-Leverage = 24 Duration = 35 minutes / Exposure: 141.9

3.- D-Leverage = 30 Duration = 45 minutes / Exposure: 201.2

4.- D-Leverage = 22 Duration = 10 minutes / Exposure: 69.57

Then, the position 3 has the greatest exposure and represents 1 trading decision. Remaining positions represent:

- Position 1: √ 109.5 / √ 201.2 = 0.73

- Position 2: √ 141.9 / √ 201.2 = 0.84

- Position 4: √ 69.57 / √ 201.2 = 0.58

Hence, the accumulate representative decisions are 1+0.73+0.84+0.58=3.15

DARWIN creation

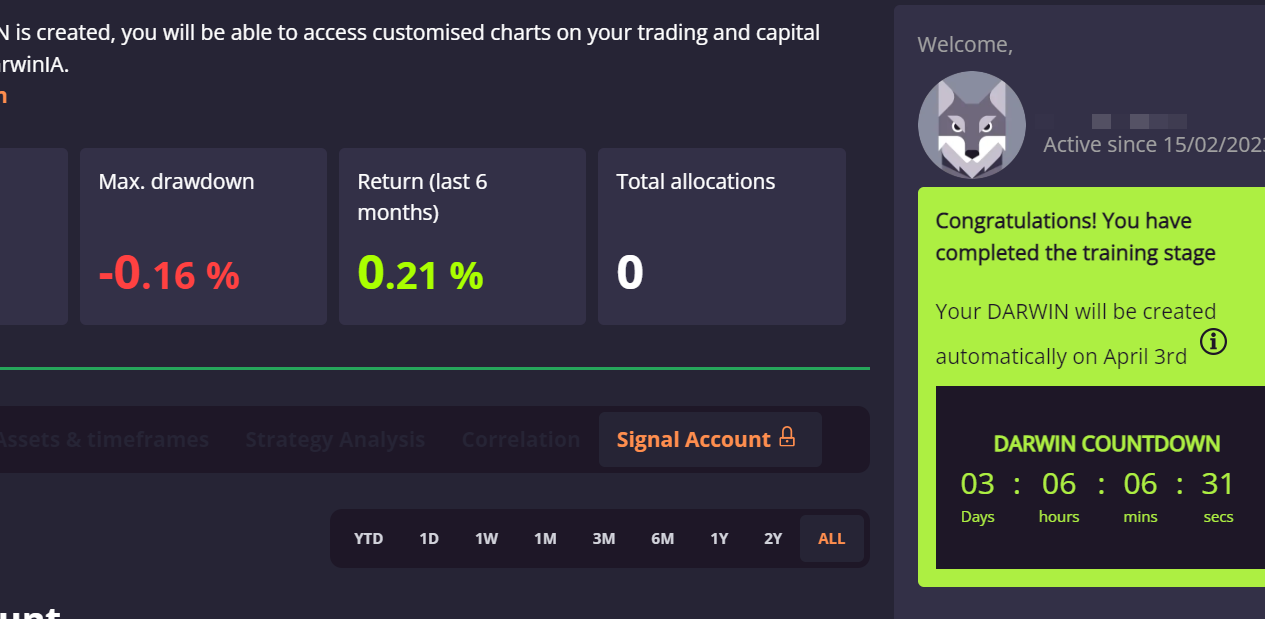

Upon meeting this criteria, your DARWIN will be created automatically the next monday and you will participate in the first edition of DarwinIA SILVER.

You can keep trading once the calibration stage is completed, any trading activity will be included in the DARWIN once it's created.

You will be able to check a progress bar in the righ side of the screen. Once the experience needed is achieved, the date for the expected creation will be available:

Do you want to learn more?

If you want to learn more about the initial calibration stage, we encourage you to watch the following video: