- 27 Nov 2023

- 2 Minutes to read

MetaTrader risk management

- Updated on 27 Nov 2023

- 2 Minutes to read

Leverage and margin

In Forex and CFD markets traders can trade with leverage.

This means that they can invest more than the equity reflected on their trading accounts as long as they can offer a guarantee called "margin".

This guarantee is necessary because:

- there might be sudden price moves in the market, and

- price gaps can happen during certain events, whether the market remains opened or closed.

Losses in open trades should never be higher than the available equity of a trading account.

However, a sudden move could result in a negative balance on the trading account which would result in the trader having a debt with the broker.

The guarantee, or "margin", the broker asks for depends on:

- the historical liquidity and volatility of an asset, and

- estimated future liquidity of the asset.

While historical liquidity determines the guarantee the broker asks for by default, estimated future liquidity determines temporary margin requirement increases a broker might introduce prior to certain events which are thought to reduce liquidity, for example, the Brexit referendum.

Margin requirements at Darwinex Zero

Margin requirements for assets offered by Darwinex can be consulted here.

The % indicated as margin requirement is the % of the nominal value of your trade that you'll have to come up with as margin.

However, not all assets require the same margin.

While the lowest margin is 10%, which is the same as a maximum leverage of 1:10, there are assets with a margin as high as 50%, which equates to a maximum leverage of 1:2.

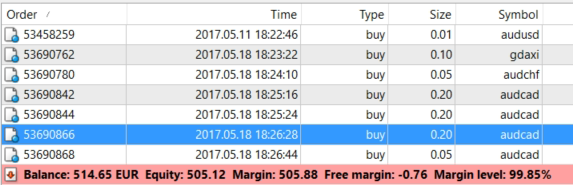

Information to watch out for in the MT4 terminal:

Balance: Funds deposited plus profits and losses already realized.

Equity: Balance plus the floating profit/loss of open trades.

Margin: The guarantee you are being asked for having open trades.

Free Margin: the difference between the Equity and the Margin of a trading account.

Margin Level: (Equity ÷ Margin) × 100. If your equity is $8,000 and your margin is $2,000 then your margin level is 400%.

Margin Call

When your margin level goes below 100%, that is, when your equity starts to be lower than your margin and your free margin lower than 0, the trading terminal will warn you of a shortage of funds. This is called a margin call.

A margin call will only be visible when logging into your trading account and no email notification will be sent to you upon your account entering margin call.

Margin Stop

When the margin level goes below 50%, that is, when the equity starts to be less than half of the margin, the trading terminal will start to close trades automatically, starting with the trade with the biggest loss.

Other things to consider

While a hedged position does not require margin, its P&L is calculated based on the BID price for long trades, whereas a short trades' P&L is calculated with reference to the ASK price, which means that a hedged position with a significant volume is at risk of triggering a margin stop in case of a sudden spread increase.