- 28 Oct 2025

- 5 Minutes to read

Performance fees

- Updated on 28 Oct 2025

- 5 Minutes to read

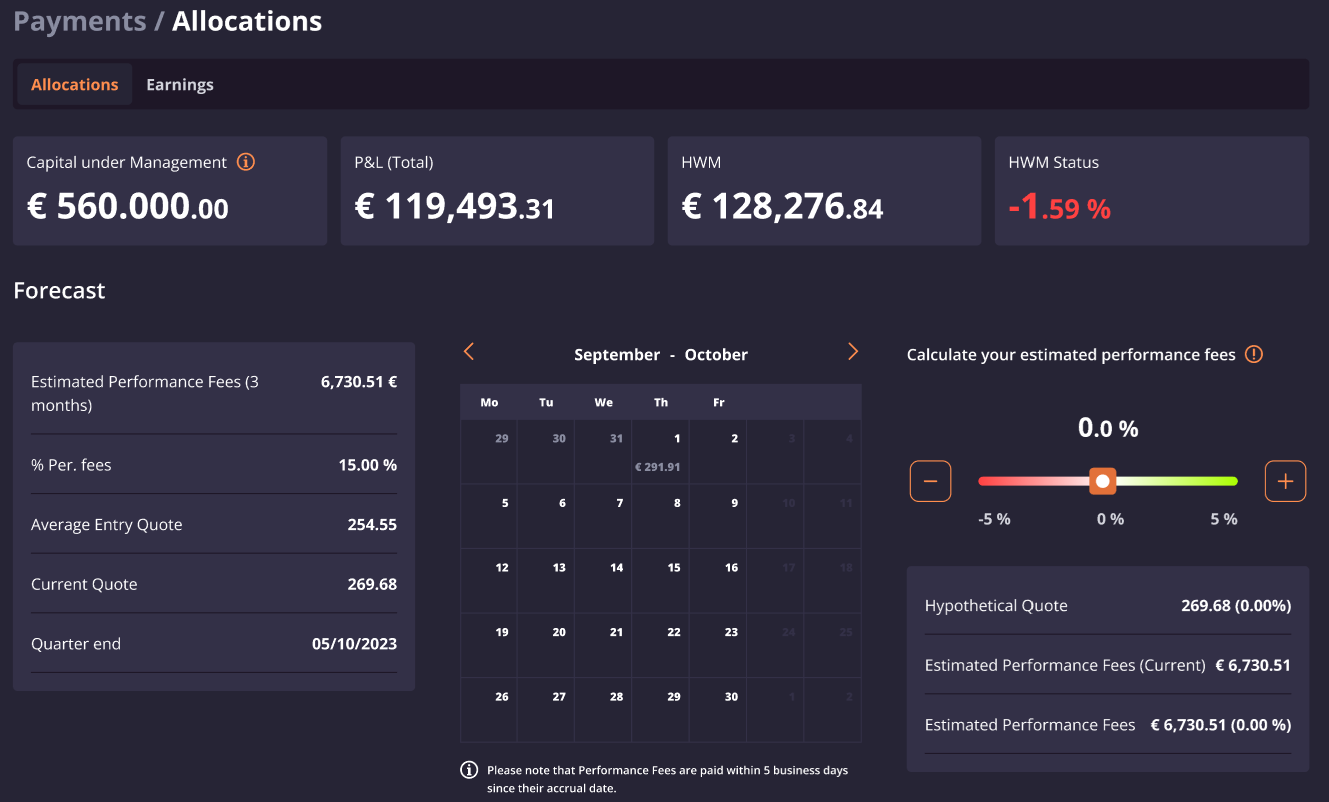

Darwinex Zero pays a 15% performance fee based on the return achieved with the capital allocated, using the HWM (high-water mark) method.

How is it calculated?

The calculation depends on two elements.

- The high-water mark

- The time period:

- Monthly

- Quarterly

1. The high-water mark

The high-water mark, or HWM, is a widely used concept in the asset management industry as a reference for the fees that managers should receive.

Using this method we ensure that they only receive fees for the profits they have actually generated and that this does not overlap with profits from previous time periods / avoiding paying performance fees for the same performance twice.

At Zero, the performance fees are calculated and paid either monthly (exclusively for DarwinIA Allocations, Permanent Allocations and Boosters) or quarterly.

By default, performance fees are charged quarterly, meaning every three months. The quarter begins when the first allocation is received in the DARWIN. Subsequent allocations will not change the calculation and payment date, as it is set based on the date of the first allocation.

Monthly High-Water Mark (Monthly HWM)

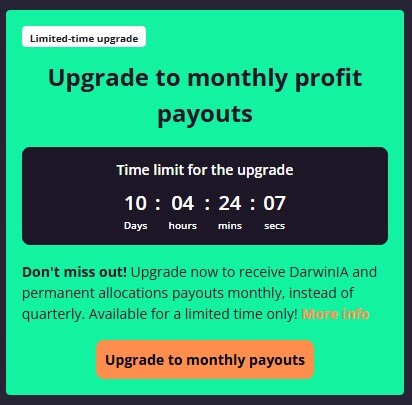

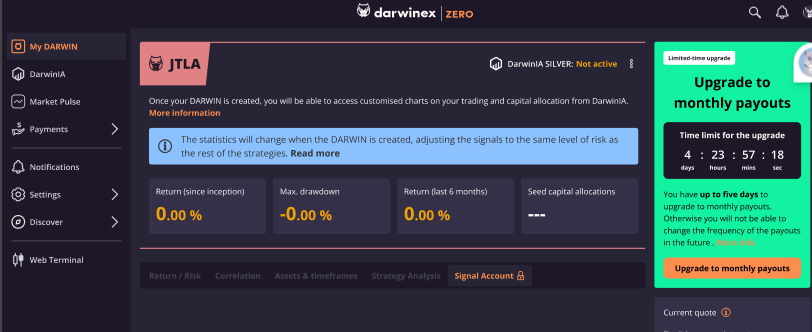

You can opt to have performance fees generated by capital allocations, whether they are from DarwinIA , permanent capital allocations or Boosters, paid monthly. The monthly HWM does NOT apply to investor capital, which will always pay performance fees on a quarterly basis. To enjoy this modality, the procedure varies depending on whether the client is new, an existing client with an active subscription, or an existing client who decides to restart their account.

For new clients or existing clients restarting their account: After paying the initial or restart subscription, once you access your Zero user session, you can activate this option in your user profile. The cost will be an additional €12/$13 per month, charged along with your monthly fee.

You can opt for this monthly performance fees payment method for 14 days from the date of acquiring the initial subscription or restart. After this period, you will not be able to contract it unless you restart your account.

The following table shows the cost of Zero's monthly subscription including the monthly HWM cost:

Example of a chart showing DARWIN quote progress

Let's look at an example for 3 months and 1 month.

Imagine the investor has remained invested for 3 quarters.

.png)

In the chart, we can see how the HWM is calculated as months pass.

In the third month, HWM1 is calculated for the profit generated in this quarter. In this case, €10,000 in profit would have been obtained (and consequently, €1,500 in performance fees would be paid).

In the following quarter, a new HWM would not be generated, as €7,000 would have been lost in this quarter, and initial profits would have been reduced to €3,000. However, at the end of the third quarter, HWM1 is surpassed again by €1,000, establishing a new high-water mark: HWM2. In this way, performance fees would be paid for the difference between HWM2 (€11,000) and HWM1 (€10,000), which is €1,000 in additional profit and €150 in performance fees.

In the case of monthly performance fees calculation, the high-water mark would be set after the first performance fees payment and would be paid again if, at the end of the following month, the high-water mark established after the first month of fee payment has been surpassed.

In month 2, HWM1 is calculated for the profit generated in this month, since capital was allocated in the first month. In this case, €1.000 in profit would have been obtained (and consequently, €150 in performance fees will be paid).

In the following month, a new HWM would not be generated, as €500 would have been lost in this month, and initial profits would have been reduced to €500. However, at the end of the third month, HWM1 is surpassed again by €2,000, establishing a new high-water mark: HWM2. In this way, performance fees would be paid for the difference between HWM2 (€3,000) and HWM1 (€1,000), which is €2,000 in additional profit and €300 in performance fees.

How is it applied in Darwinex Zero?

In what situations can a reset occur in DarwinIA allocations?

1. A reset occurs in one of the following situations:

- Scenario 1: All DarwinIA allocations expire, closing with losses. These losses are fully covered, resetting the P&L to 0% for the next allocation.

- Scenario 2: While having losses greater than 5% in active allocations, you receive a new allocation, or an allocation is closed while another remains active. In this case, the accumulated loss is capped at -5%, and you must recover this loss to generate performance fees.

2. How does the reset mechanism work with real numbers?

Scenario 1:

- A trader has three consecutive allocations with an initial capital of €30,000 each.

- During these allocations, the trader incurs a cumulative loss of -€3,000.

- When all allocations expire, the total losses (-€3,000) are covered, and the P&L is reset to 0% for the next allocation.

- This allows any profits in new allocations to generate performance fees from the beginning.

Scenario 2:

- A trader has a DarwinIA allocation of €30,000 .

- During the first month, the trader incurs a loss of -10% (€3,000).

- In month 2, the trader receives a new allocation, triggering a reset to -5% (-€1,500).

- The trader earns €5,000 in profits from this point, recovering the accumulated loss and gaining an additional €3,500. Performance fees are calculated based on these €3,500 (instead of €2,000 if the reset had not occurred).

3. What is the purpose of the reset?

The reset mechanism aims to facilitate the payment of performance fees. Without the reset, traders would need to recover the entirety of their losses before earning new performance fees.

4. How does the reset impact performance fees?

- In Scenario 1, the trader starts the next allocation without losses, allowing performance fees to apply to any new profits from the start.

- In Scenario 2, performance fees apply only after recovering the -5% loss. For example, if the trader recovers to a P&L of +10%, performance fees are calculated on the profits above the recovery threshold (from -5% to +10% in this case).

The time period (a quarter)

At Darwinex Zero performance fees are charged per DARWIN on a quarterly basis, i.e. every three months. The quarter starts when the first allocation has been received in the DARWIN. Successive allocations have no effect on the starting date of the quarter, as this is set uniquely based on the first allocation date.

Each time the quarter ends, if the previous high-water mark has been surpassed, 15% of the net profit (closed profit + open profit) generated in the quarter will be paid to the trader.

Where can I see this?

All the information available relating to current Capital under Management, P&L and HWM can be found at Payments->Allocations:

.png)